29+ Back end debt to income ratio

Web Lenders offer 100 financing on USDA loans due to the government guarantee by the USDA. Ad Compare Personal Loan Lenders.

Mortgage Tips And Tricks Assumption Assuming A Mortgage Home Mortgage First Time Home Buyers Mortgage Tips

Now assume you earn 120000 per year which would be 10000 in gross monthly income.

. Web A standard maximum debt-to-income calculation for mortgages is 43. Web Back-End Ratio All Monthly Debt Gross Monthly Income Check out our Online Debt Snowball Calculator which helps you understand how to accelerate your debt payoff. Web It is equivalent to a 30 back-end ratio.

Web To calculate his DTI add up his monthly debt and mortgage payments and divide it by his gross monthly income to get 032. To determine your DTI ratio simply take your total debt figure and divide it by your income. If your lenders DTI limit.

Get Instantly Matched with the Best Personal Loan Option for You. Ad 7 Best Personal Loan Company Reviews of 2022. Web This number will be compared against your income to calculate your back end ratio.

Get Up to 100000 from 349 APR. Web You would have 2900 in monthly debt payments. Web The next step in calculating your DTI is dividing the total debts by your monthly income.

Web Debt to Income Ratio 5500 2440 443 The DTI guidelines for FHA mortgages allow for a maximum of 43. USDA loans are only limited to areas where the USDA classifies. However if she owes 1200 per month while continuing to earn 5000 she would yield a 24 back-end ratio.

Checking your rate wont hurt your credit score. Skip the Bank Save. Make sure you use your gross monthly income.

Web Today the debt ratio requirements for an FHA loan are 29 front-end ratio and 41 back-end ratio based upon gross income. Your lender will likely use your open credit accounts showing on your. So this percentage gives a better frame of.

Web Back-end debt-to-income ratio is more comprehensive in that it takes into all of your debt payments beyond housing. Web Back-end ratio is the percentage of income that goes toward paying all recurring minimum monthly debt payments in addition to the monthly mortgage costs covered by the front. Multiply that by 100 to get a percentage.

Conventional loan debt ratios are 28 front-end and. Low Fixed APR from 399. Web Back-end DTI some of the time called the back-end ratio works out the percentage of gross income going toward extra debt types for example credit cards and vehicle loans.

This percentage represents the highest DTI ratio permitted for qualified mortgages loans that. In this example if you apply for a mortgage with your spouse your front-end DTI ratio will be 2053 and your back-end DTI ratio will be 3417. A good back-end DTI ratio is typically no more.

Fast Easy Approval. Web A back-end DTI calculates the percentage of gross income going toward other types of debt credit cards car loans etc Back-End DTI Total monthly debt expense. Web Back-end DTI.

Your back-end debt-to-income ratio includes your housing expenses plus all your other monthly debts. Comparisons Trusted Low Interest Rates. However these guidelines allow for higher ratios of up to.

Web Back end the debt to income ratio on the back end includes all expenses including housing.

Why Are Long Term Investments In The Stock Market Considered Good Quora

Back End Debt To Income Ratio Debt To Income Ratio Debt Ratio Debt

Premium Photo Contribution Margin Business Concept Message On Sticker On Chart Background

What Are The Tax Implication In Indian Stock Market Quora

2

Pdf Tqm Of Unilever Akhi Nur Academia Edu

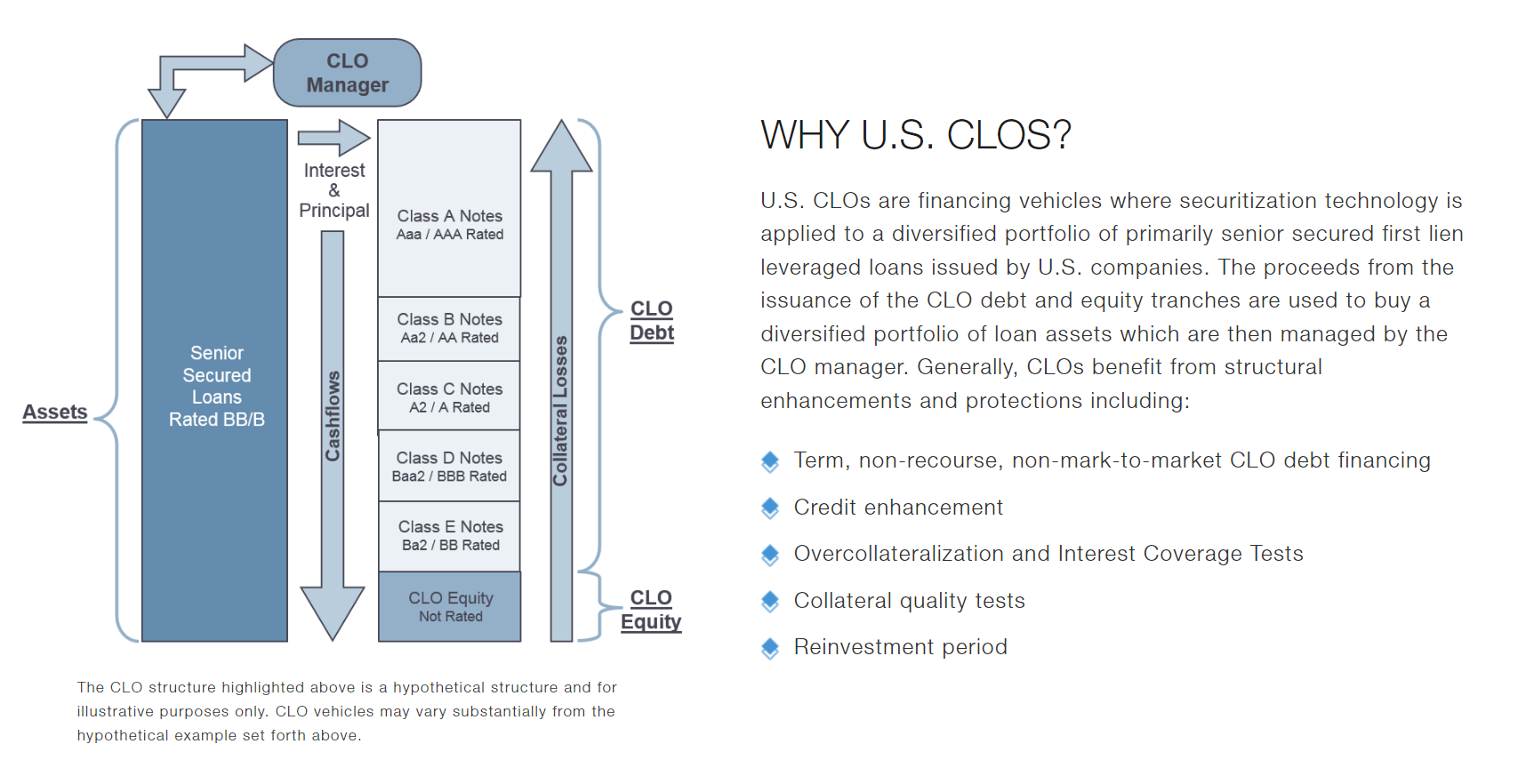

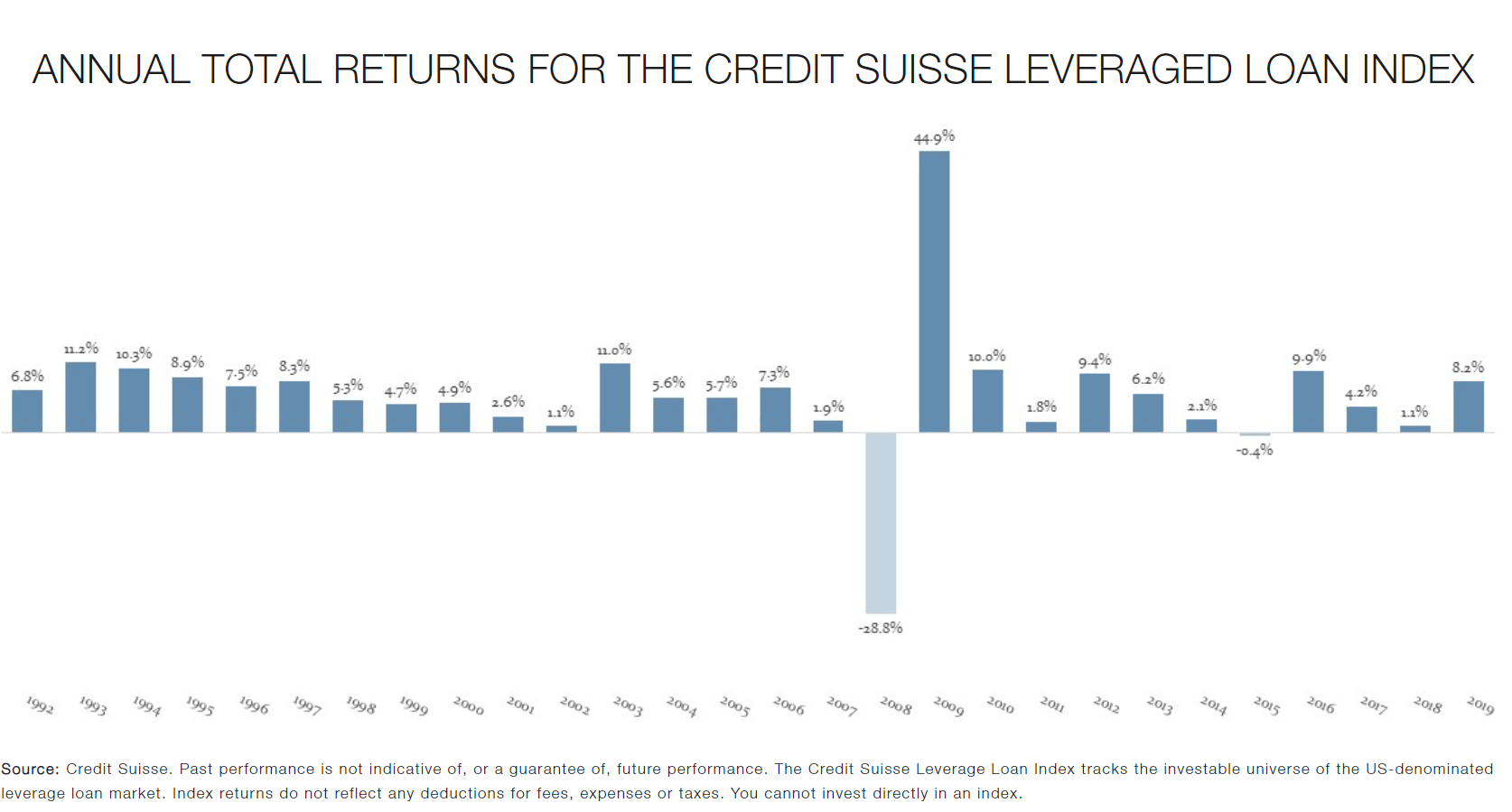

Oxford Lane Capital Stock Look Beyond The Yield Nasdaq Oxlc Seeking Alpha

Premium Vector Business Concept Teamwork Of People S Working Financial Business Calculator Flat Vector Cartoon Character Illustrations

Premium Vector Core Values Concept For Landing Page Template Tiny Businesswoman Character Holding Huge Puzzle Piece With Basic Social And Business Principle Vision Work Presentation Cartoon Vector Illustration

Liability Vs Debt Head To Head Difference Debt Liability Debt Ratio

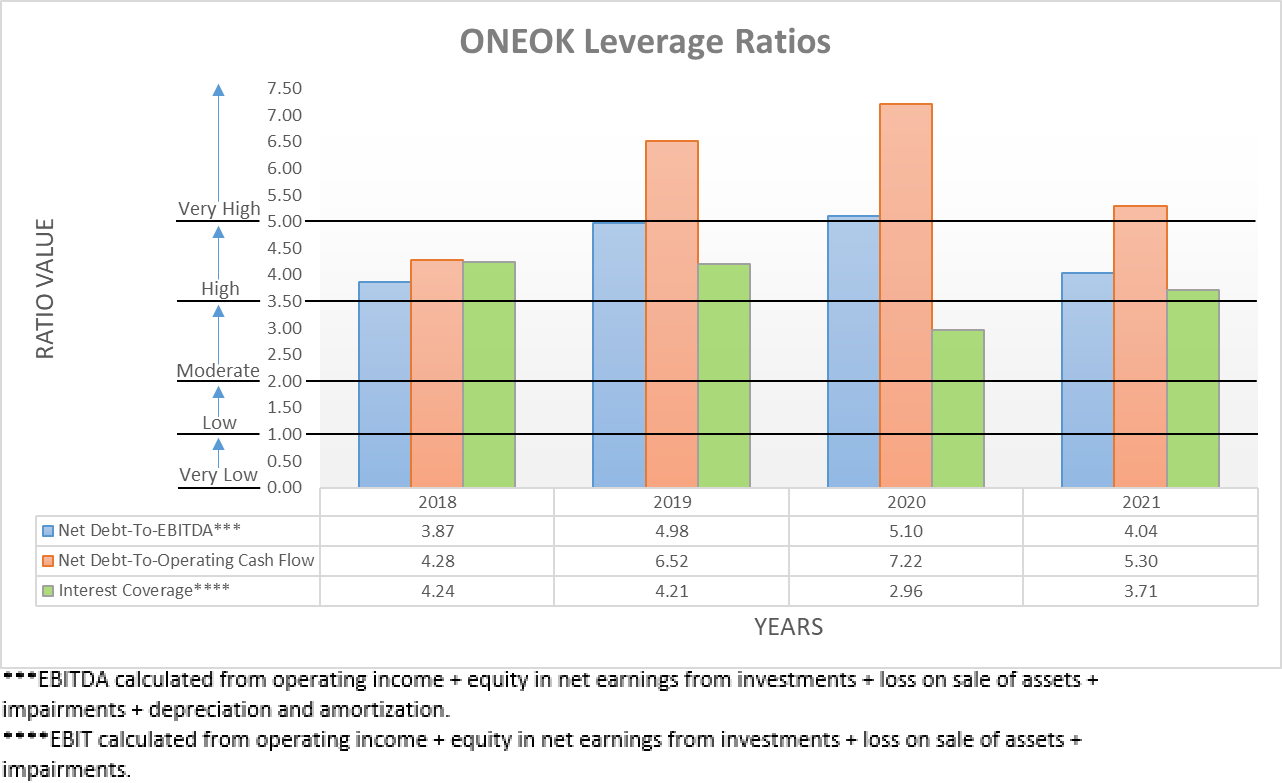

Oneok Strong Performance A New Era For Dividends Nyse Oke Seeking Alpha

How To Use Ratio Analysis For Your Business Financial Ratio Business Valuation Balance Sheet

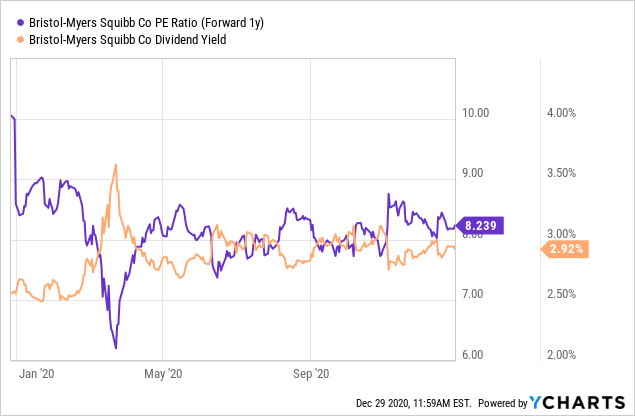

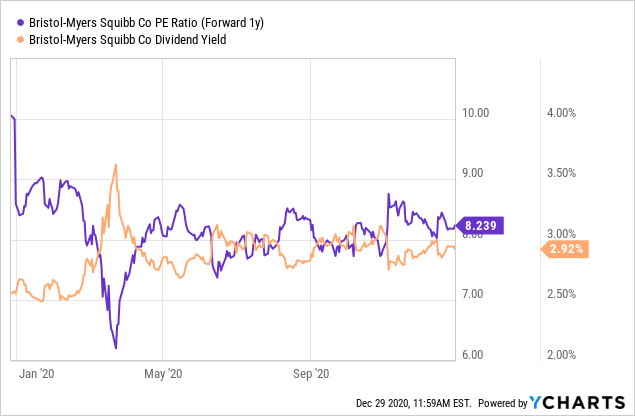

Top 10 Undervalued High Yield Income Stocks For 2021 Seeking Alpha

Premium Vector Core Values Landing Page Template Tiny Businesspeople Characters Stand On Ladder Holding Huge Puzzle Piece With One Of Basic Social And Business Principles Mission Cartoon People Vector Illustration

Oxford Lane Capital Stock Look Beyond The Yield Nasdaq Oxlc Seeking Alpha

Oneok Strong Performance A New Era For Dividends Nyse Oke Seeking Alpha

What Is A Personal Loan And How Does It Work In 2022 Personal Loans Financial Management Balance Transfer Credit Cards