32+ Small loan with low credit score

All you need is a credit score of 580 to get an FHA loan combined with a lower down payment. However youll have to make up for it with a larger down payment if your credit score is lower than 580.

Best Honda Accord Lease Deals In Naperville Il Edmunds

Why we chose an APR of 941.

. Congrats on the A. For businesses with a low PAYDEX score here are a few loan options to consider. Best companies to refinance your car when you have bad credit.

Race has a huge impact on credit scores and other credit issues. FICO considers a score between 800 and 850 to be exceptional while VantageScore considers a score above 780 to be excellent Its possible to get an 850 credit score but its tough to achieve. They offer low interest rates and a variety of loan amounts and loan terms to help you meet your personal and financial goals.

HELOCs depend greatly on credit scores and are most available to people with FICO scores above 720. The best credit score and the highest credit score possible is 850 for both FICO and VantageScore models. 2020 2021 Change.

Those with a score between 620 and 659 will pay 765 for a new car and 1126 for a used car loan. According to Experian data the average credit score for a car lease in the second quarter Q2 of 2020 was 729 putting it right in the middle of the prime borrower categorythose with credit scores of 661 to 780. Depending on the.

Why PenFed is the best personal loan for small loan. 2021 at 1032 am. Best for below-average credit.

Transform Your Small Business. Look into these factors before you start the application process to make sure you get the best personal loan for you. Why its important to compare low-interest loans.

For instance you may use a personal loan to consolidate debt pay for home renovations or plan a dream wedding. While a prime credit score gives. A FICO score is a type of credit score created by the Fair Isaac Corporation.

Loan amounts from 600 to 100000. The best bad-credit loan is. Which small Business Credit Cards Report to Business Credit.

While this number depends on the amount you borrow your credit score and your current finances this national average highlights what. Yes with a free Nav account it shows a letter grade. Why PenFed is the best for small loan amounts.

Lenders use borrowers FICO scores along with other details on borrowers credit reports to assess credit. According to credit bureau Experian the minimum FICO score for a HELOC is 680. But it wins out in finances Australia scores better than Canada for tax pressures and earns an 80 score for interest rates beating the USs 70 score and Canadas 65 score.

Borrower average is 722. Best for small loan amounts. 32 East 31st Street 4th Floor New York NY 10016.

Credit scores of 630 to 689 and 285 percent to 320 percent for poor credit scores of 300 to 629. The average discount a consumer could expect at the beginning of the pandemic was 3000. A low credit score.

The average homebuyer who closed on a VA loan within the last year and a half had a credit score in the low 700s. Get a low interest rate personal loan and save hundreds if not thousands of dollars. The minimum credit score.

Rather than pick a random APR for our example we used consumer credit data from the Federal Reserve that found in the first quarter of 2022 the average APR on a two-year personal loan was 941. To help narrow your search we used application data from LendingTree partners to. Since PenFeds low-interest personal loans start at just 600.

You may also want to consider adding a cosigner to the loan to minimize your risk profile. Check personal loan rates for free in 2 minutes without affecting your credit score. When you lease a car your credit score plays a role in the type of vehicle you can get as well as how much youll pay.

Your lender or insurer may use a different FICO Score than FICO Score 8 or another type of. 3 Vendors That Will Help You Build Business Credit. A 2018 report found that 32 of African Americans and 28 of.

USDA Loan Credit. You may be able to get a loan with a credit score as low as 500 points if you can bring a 10 down payment to closing. A personal loan is an amount of money you can borrow to use for a variety of purposes.

Average Auto Loan Balance by FICO Score Range. Have a low credit score. Refinancing a car loan when you have bad credit means taking the time to compare rates and terms from multiple lenders.

Borrowers with the worst credit score 579 or less will pay 1439 for a new car loan and 2045 for a used car.

3 Types Of Personal Loans In Canada To Look In 2021 Personal Loans Loan Financial Planning

Seacomm Federal Credit Union

Columbia Banking System Inc 2021 Annual Report 10 K

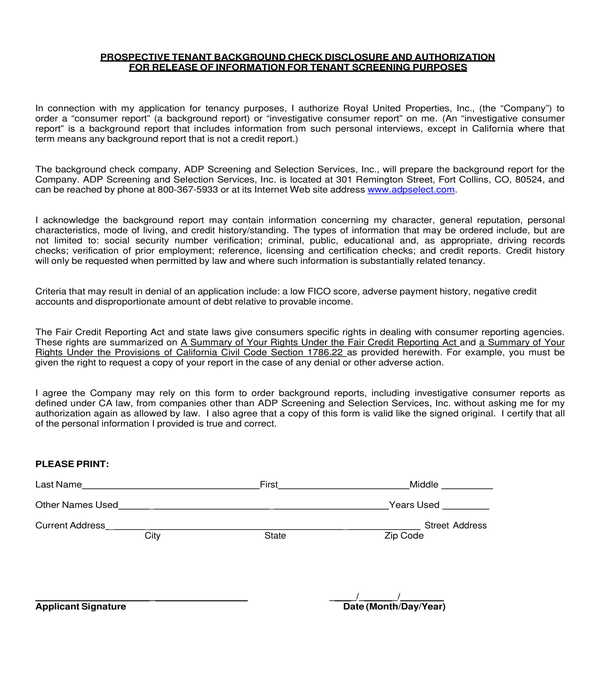

Free 5 Tenant Background Check Forms In Pdf

2f3ilcbrmxyhdm

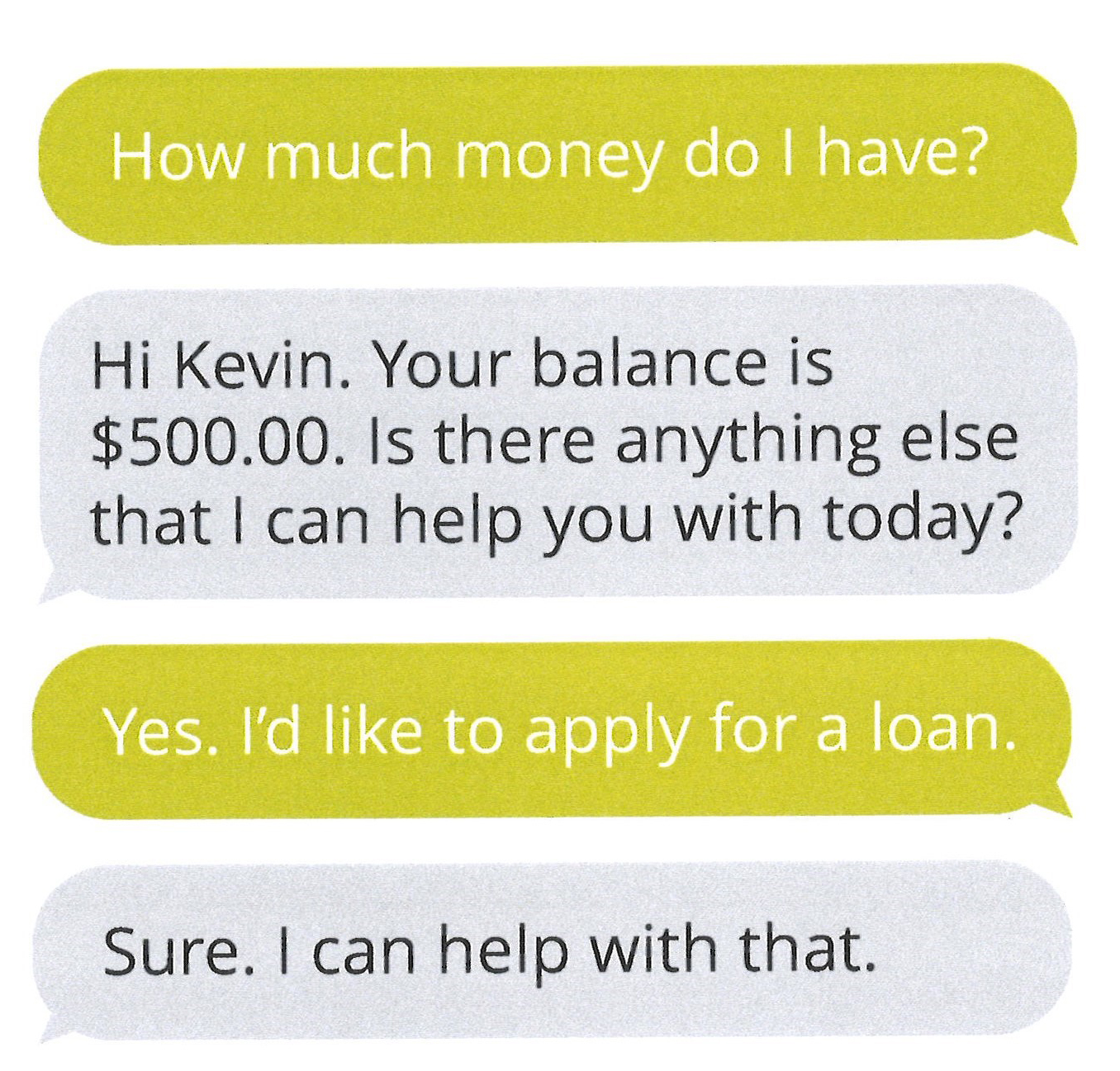

Ai For Mortgage Lending Automation

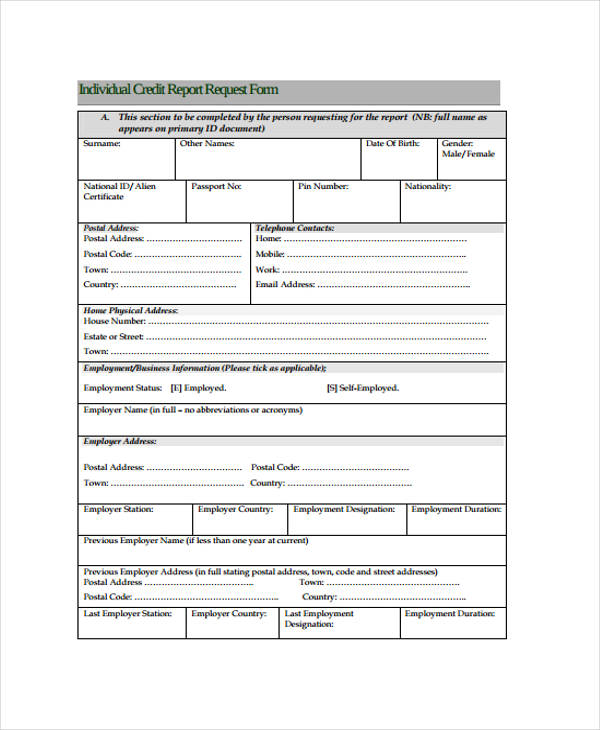

Free 24 Credit Application Forms In Pdf

Points To Consider While Applying For A Personal Loan Personal Loans How To Apply Loan

Myths About Personal Loan Personal Loans Loan Infographic

Don T Go Bust Borrowing Useful Credit Solutions Infographic No Credit Loans

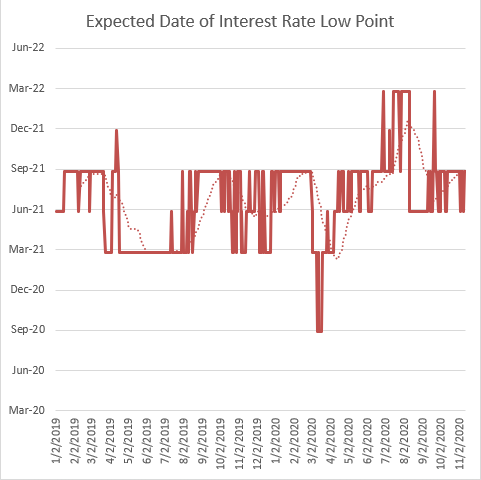

Idiosyncratic Whisk 2020

Idiosyncratic Whisk 2020

Idiosyncratic Whisk 2020

Pin By Heather C On Credit Credit Repair Business Improve Credit Improve Credit Score

Assuming A Mortgage After Divorce Unhappy Marriage

2

Economist S View The Role Of Securitization In Mortgage Lending